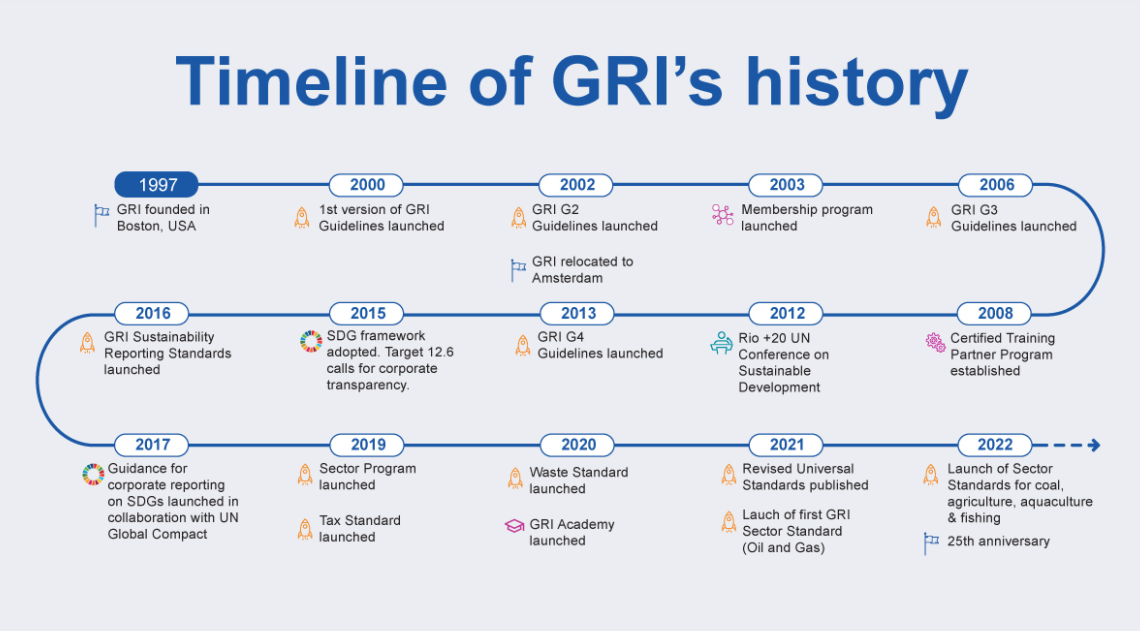

Synesgy updates its questionnaires according to the GRI Universal Standards

Synesgy's success are the dedicated questionnaires, which are based on timely and rigorous references of global ESG market regulations such as UNGC, GRI, UN 17 SDGs, EBA LOM, and EU Taxonomy for Sustainable Activities.